Company Profile

| Name | Suzuyo & Co., Ltd. |

|---|---|

| Corporate No. | 2080001009460 |

| Founded | 1801 |

| Established | 1936 |

| Capital | JPY 1 billion |

| Representative |

Chairman & CEO Yohei Suzuki President & CEO Kenichiro Suzuki |

| No. of employees | 1,146 (as of August 31st 2024) |

| Annual sales | JPY 159,755 million (as of fiscal year end August 2024) |

| Businesses | Port transportation, Surface transportation, Domestic coaster, Car transportation, Car transportation handling, Car forwarding, Customs brokerage, Bonded warehousing, Ocean cargo handling, Air cargo handling agency, Ship agency, Leasing, Pest control, Wharfage, Warehousing, Information handling, Real-estate agency, Classified document collection and destruction, Manufacturing (Medical device/Animal medical device/Cosmetics/Medical goods/Quasi-medical goods/In vitro diagnostics pharmaceuticals) etc. |

| Licenses held |

Warehousing, medical device manufacturing, highly controlled medical device sales/rental, cosmetics manufacturing (packaging/labeling/storage), quasi-pharmaceutical products manufacturing (packaging/labeling/storage), veterinary medical device manufacturing business First-class consigned freight forwarding business, second-class consigned freight forwarding business, general trucking business Customs brokerage, AEO Port and harbor transportation business Shimizu Port:1-1, 2-1, 3-1, 4-1, 5-1, 6-19, 8-29 Mikawa Port: 1-1004, 2-2, 4-1 Keihin Port: 1-1065 Poisonous and deleterious substance sales business, storage space according to the Fire Service Act, storage space according to the High Pressure Gas Safety Act, manufacturing license according to the High Pressure Gas Safety Act ISO13485、ISO27001、ISO9001 Antique dealer |

| HQ Address | 11-1, Irifune-cho, Shimizu-ku, Shizuoka-shi, Shizuoka-prefecture, Japan |

Annual Report

Logistics Segment Performance Trends

-

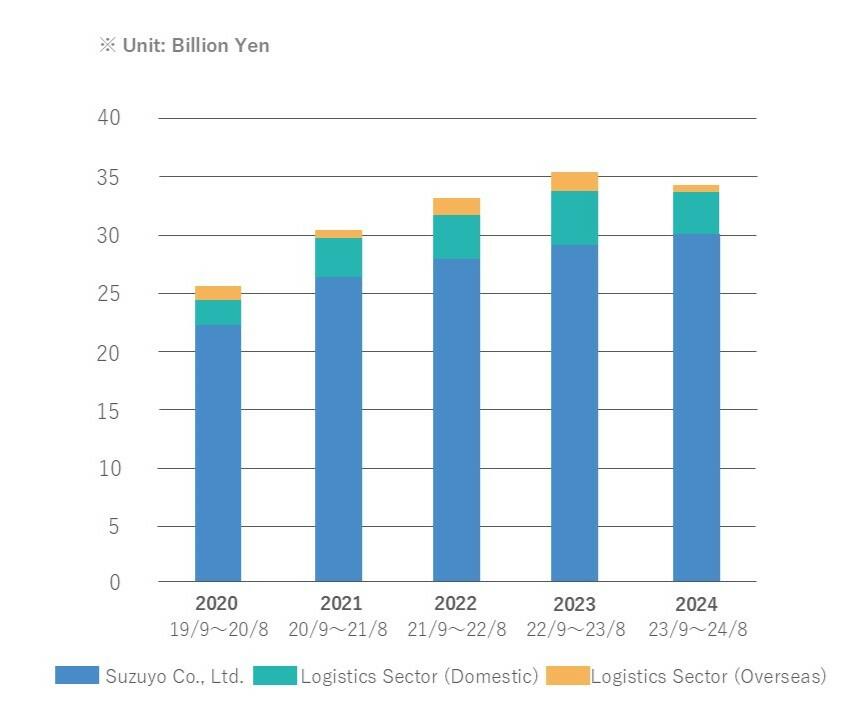

Annual Sales

-

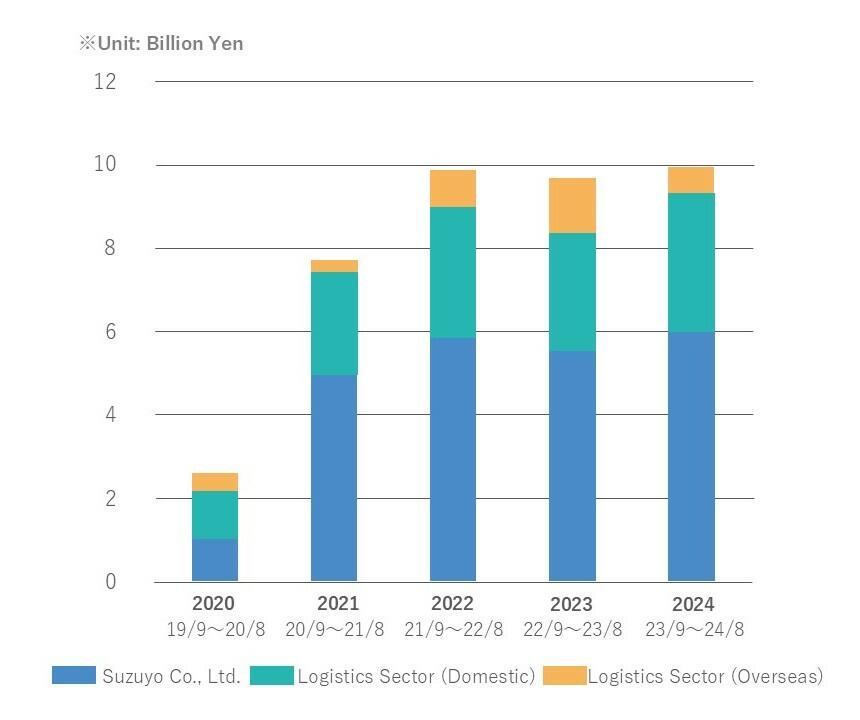

Net Profit

-

EBITDA

About EBITDA

EBITDA is an indicator of corporate value evaluation, which refers to Earnings before Interest, Taxes, Depreciation and Amortization.

The calculation method is the operating income plus depreciation cost, and can be regarded as operating cash flow (cash-based profit).

Because interest rates, tax rates, and depreciation methods differ from country to country, EBITDA, which eliminates these differences, is a useful indicator when comparing and analyzing international corporate value.

In addition, companies with large capital investments will have a greater impact on the profit from depreciation expenses, so eliminating this effect will allow you to assess the growth potential of the profit from the investment.